🏆 Free Crypto & Economic Report Out Now!

📈 TIA Gann Swing Indicator

🔐 Crypto Storage LEDGER

Subscribe to Michael’s Channel

Bitcoin has been pumping uncontrollably for the last 7 days. Is the Bitcoin and Crypto bull market back on? Let’s discuss key signals to watch for confirmation of the trend changing!

The SP500 Trifecto Indicator for a positive 2023!

UP TO $48,755 FREE! Crypto Exchanges

🥇 ByBit Free $30,030 + 0% Maker Fees (NO-KYC)

🥈 Bitget Free $8,725 (US + Global Users NO-KYC)

🥉 OKX Bonuses $10,000 (US + Global Users No-KYC)

🇦🇺 Swyftx, Best Australian Crypto Exchange

▶ My Official Socials ◀

YouTube

Instagram

Twitter

▶ My Must-Have Crypto Resources ◀

Education – TIA PREMIUM MEMBERS, Trading Courses & Exclusive Community

Charting – TRADINGVIEW ($30 Off)

Storage – LEDGER

Tax – KOINLY (20% Off)

Trading – TIA GANN SWING INDICATOR

This video is for entertainment purposes only. It is not financial advice and is not an endorsement of any provider, product or service. All trading involves risk. Links above include affiliate commission or referrals. I’m part of an affiliate network and I receive compensation from partnering websites. #crypto #bitcoin #cryptonews

There's almost no hiding it anymore the Major stock markets around the world are Approaching all-time high prices again As investors as I believe you are here Watching this channel you're interested In making money from the market although There's a lot of hurt happening around The world especially at the lower end of The socio-economic scale we can't deny The facts that are as in the charts and The data which is leading prices to new Higher levels in the case of the Dow Jones we are seven percent away from a New all-time high the UK Market is Within one percent of a new all-time High the Aussie Market is fast Approaching a new all-time high again How is this possible and how can we Forecast the next 12 months in these Major stock markets around the world in Today's video we're going to look at a Massive Trifecta of signals coming Together which would be absolutely Painful for you to bet against these This is for the average investor and the Smart money as well and as we'll see From today's data it doesn't look like The smart money is going to get it wrong Again in 2023 they're usually on the Right side of the market and that's what We're going to look at in today's video How we can get ahead of the trend before The major news outlets the major crypto Influences Financial influencers out

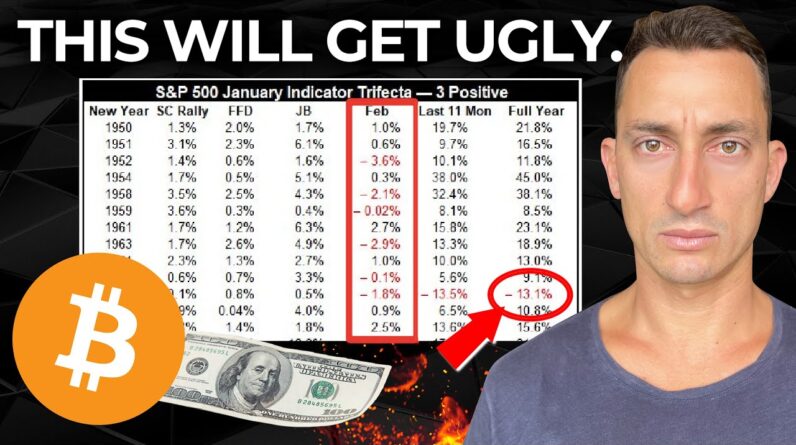

There start to flip from recession Depression bad times ahead in 2023 and They start to flip into the more Positive side of the market and probably A little too little too late now this Isn't the first video that we've put Together on the channel about the macro Economy this of course is your home of The macro cycle so make sure you do Subscribe like all those things down Below you know the drill and of course I'll leave a link to these videos at the End of this video here we've looked Discussed many major macro signals here Going all the way back to the s p we Also have the major fund managers Reports where they are heavily Underweight in the the stock market and Of course timing Bitcoin bottoms you Heard me right using different signals On the timing aspect the price aspect And of course Market sentiment so Without further Ado let's crack on with Today's video looking at the major Trifecta of signals here now the Tri-factor of signals is put together by Jeff Hirsch here and I'll run you Through them in terms of what exactly They are this goes back to 1950 so over 70 years of data we need three things to Come together at the beginning of the Year and this calls the market nearly 90 Percent of the time nearly nine times Out of ten as to what will happen at the

End of this year is it going to be a Positive year as you've probably picked Up from the channel as well I've been Doing this with Bitcoin through our Monthly analysis videos I've got a Playlist for that on the channel of Course I'll leave a link to that at the End of the video as well which helps us Identify what we're looking out for at The end of that month and of course the 12 months of ahead we've looked at that For November December and January as Well as I put that out the beginning of The month here on the channel so the Three things that we're looking for here Santa Claus rally that's the SC rally The ffd first five days of the year and Then also this is the January barometer I believe is what B is here so basically What is the price of the s p at the end Of January so we just simply look at the The data through here if you've got a Positive Santa Claus rally I believe These this data is taken from the end of December into the first couple of days Of January also the first five days That's pretty straightforward and then Of course the January reading is the January month up what tends to happen 28 times out of 31 is that you'll get a Positive year ahead so the next 11 Months you can see the data right right Through these readings right here okay So that's what it is here and basically

The average is about 12 up on the year So think about where the market opened On the S P at the beginning of January And then in terms of an average just Look at where that is at the end of the Year so the market for the s p opened at 38.53 12 up from that call it around 30 390 points so nearly 400 points up from That 38 and a half that's going to lead Us 48 400 points nearly around 4 300 so That's just on an average here but it Can go a lot higher than that and of Course be it less but overall nine times Out of ten we're getting a positive Reading for the year so the year is Going to be up that's pretty different To what the major Economists the mainstream economists the Mainstream media and basically everyone Else that seems to be in that Smart Camp Is calling for a major depression in This year now come course we can always Be wrong and maybe we get another down Reading here but it's pretty hard to Start betting against these odds once we Start to see a lot of these signals come In not to mention the other dozen Signals that we've talked about here on The channel extensively through these Videos which I know can be quite long Between 15 and 25 minutes typically Around that 17 or 19 minutes and so Rather than repeat those over again as I've mentioned I'll leave them linked to

It at the end of this video today's Video we're focusing on this particular Data right here the other thing we have To keep in mind for this particularly Year and I know I've talked about it on The channel is the pre-presidential Election year so next year in 2024 is an Election year this is the Pre-presidential election year many Times eight to nine times out of ten These years are also positive basically The year before the election the market Heads up pretty heavily very high very Fast as well we've covered that on the Channel so in pre-presidential election Year such as this our first five days Has a respectable record with 13 full Years following its direction in the Last 18 years so basically 70 of the Time as well this works out in terms of Just election years as we've looked at Before dating back to the 1920s it's About very close to nine times out of Ten when all three indicators were Positive the next 11 months have been up 87 of the time with an average gain of 12.3 percent and so as we covered on the Chart here if we're looking at an Opening price for the month of January Being at 3 850 then if we run this Figure up approximately 12 percent we're Going to get a reading somewhere around The 38 20 Level this of course would Take us above the monthly swing top

Which is what this orange swing Indicator is you can find a link to this At the top of the video description you Know I had to get that shill in for our Gan swing indicators one of the best Well it's my major indicator that I use For trading and investing giving me Indications of Market Trend changes for Extreme pivotal points in the market in Particular the monthly swing tops and Bottoms basically telling you that the Trend is firmly changing with that macro Environment so that's the monthly Indicator that you can use it on any Time frame minutes hourlys dailies for Any sort of trading as well basically That would take us above the monthly Swing top and also the monthly swing top Of August so it really put us into a Very positive and strong position for The market to then continue building on Into 2024 2025 2026 as we lead into the Peak of the next economic and real Estate cycle which is what we are Anticipating here and so far nothing has Changed our opinion of that cycle Everything is working out to a t for This cycle to continue up later this Decade before we do get a major lapse in The market and if you're new to the 18.6 Year cycle or to my Channel please do Stick around subscribe like we'll Continue to talk about that as we lead Into that Peak now as I've pointed out

Many times second half of 2022 and first Half of 2023 are going to be great Buying opportunities once we look back On it coming into the the following Years of course the other thing that Being above the 4200 and reaching this Target of approximately 4 300 just as I Said using the average here of 12 it Doesn't mean it has to be 12 it's it's Been a lot more and of course a lot less But using the average where that would Sit us is also above the major 50 point As well which is 41.55 so 4155 is that key 50 level down From this top to the October low Potentially the cycle low here and that Would then swing us back into the Positive side of the Gan retracement Tool here so that's our 50 halfway point Of the range we're also will be above The bear Market downtrend as well so We're starting to line up a lot of Positive factors here if we're to get Above this level and basically we have Approximately 13 to 14 days left of January to see whether the month of January on the s p is going to close in The positive and of course that close Needs to be above as we've pointed out Here the 3853 level now what happens if This is wrong if January is negative we Need to look at both sides of the market So we can prepare of course we are Investors here not some sort of crypto

Degens just hoping and praying for the Best thing to come we need to be Prepared for both sides of the market I Know a lot of people just don't like That they only want one side you should Be understanding that by now you need to Know what could happen on both sides of The market so you can prepare just like You were out in a game of sports or at War you prepare for both sides it's very Silly coming to a market and only Preparing for one side in the case of Just being up or just being down so if January is negative as it's shown up Here in these 12 times one two three Four five six seven eight nine ten Eleven twelve Then you still end up with a positive Reading as well so this isn't the most Critical thing for January to end in the Positive however it does start to swing The odds further in favor of the Year Ending up so there is a couple of times Here where the last 11 months meaning That 11 months of the year the last 11 Months of the year going from February To December of the current year two of These times have been negative and the Other 10 times have been positive and Out of those 10 times the average return Is only 9.9 so still a solid 10 up on The year whereas the other reading here Would be at 12.3 so a couple of percent Difference just doesn't lean itself to a

Higher close that's quite convincing Data on the S P being up at the end of 2023 should we get this next 14 days Ending up positive for the January month And I'll make a quick mention here to Jeff Hirsch if you want to follow him on Twitter putting out some great data like This all also goes a long way to helping You out with your macro picture so where Does it leave Bitcoin well as we're Recording Bitcoin is currently within 20 Of breaking its monthly swing top that Was set back in November before the FTX Scandal dumped the market we've talked Extensively about the market sentiment Around this low of 15 400 or 15 500 in The fact that this was one of the most Major events in crypto within a major Bear market across all indices yet the Market sentiment was able to find a way To climb out of this low and nearly Break above at the time of this Recording the monthly swing top as I Pointed out in the previous videos again Link to those will be at the end of this Video so stick around for that like And Subscribe so you get this content in Your news feed the major swing top that I'm looking for here is around that 25k We break this 25k we are basically all Bets off for a ten thousand dollar Bitcoin I would not be waiting around in The hopes of a 10K Bitcoin or in the Hopes of some sort of Black Swan event

Which no one can predict to get that Quick dump to the low and even in that Case maybe we only ever dump back down To the 15 or the 16k range now we're Talking about something in terms of a Black Swan event which may never occur And we can't prepare for that exactly so Let's stick with what we currently have On the chart within 20 bucks of the Swing top which means we'll start to Swing or make another check in our bull Market cycle analysis we've looked at The day counts they're all working out Relatively well and so this is basically As I pointed out on Twitter just another Nail in that coffin we've been through a Major down year here it's a very Significant negative return for BTC for That year and for the year probably 60 65 but from the top nearly 80 so a Couple of different readings there what We're looking at here thanks to Chad's BTC and thanks for the follow there is Which markets have been the best to be In so we've looked at the macro cycle Here that potentially a lot of the the Markets around the world the indices are Going to be up we have put aside what is Actually happening to the uh the economy Itself and how people are potentially Finding it hard to make ends meet with Rents with other bills with food with Energy costs that is different to making Money in the markets

What we're looking at now is where would Be the best place to put our money if we Do in fact see a major bull year or a Major second stage of this uh bull cycle Of course we need to make some Assumptions here we're basically using The data to hopefully get in early Enough to make those gains we can always Look back in hindsight and say well that Was the best that's typically what the News does that's what major influencing Outlets will do because they are Appealing to the masses but in this case We need to try and get in earlier here And identify when that would be looking At that in terms of the macro cycle we Think this and now is particularly a Good time this sort of 12 month period Second half of 2022 first half of 2023 Is probably going to be one of the best Times we'll have to see how that unfolds And look back on it but if that is the Case then we've got to go put our money Where our mouth is and over the last 12 11 12 13 years Bitcoin has of course Been the outstanding winner here we're Just looking at Bitcoin at Autumn and We're seeing the highest return and Lowest return so in any sort of down Year Bitcoin is not going to be one of The best returns 2015 proved otherwise So it's still a good year there but as We can see say for 2018 The cash was the best return there same

Deal for 2022 cash or Commodities and Commodities probably looking at things Like the energies and and potentially Metals as well but essentially cash is Going to be your place where you don't Have to speculate trying to get that Next big home run so cash in those Couple of years the rest of the time Bitcoin basically wins hands down unless It's in a major bear Market year like You could see in 2014 like you can see In 2018 like you can see in 2022 so we Got three years up one year down three Years up one year down three years up One year down and this is this is 65 Because it's measuring 2022 not from the Top of course and so if this is going to Be a good year and we go with the best Returning asset over the last 12 years Bitcoin essentially wins hands down so Although I can't give you Financial Advice the data is pointing to 2 Particular things one potentially this Is going to be a reasonably Good Year The start of that next stage of the leg Up potentially for the s p the Dow Jones The cycle low was October of 2022 as we Pointed out here on the channel as I'll Leave a link to those videos at the end Of this one here pointing out why that Was potentially the low for the S P Cycle the second thing is where should We put our money without it being any Sort of financial advice just looking at

The data over the last 12 or so years of Course Bitcoin has had some of the Highest returns of course we could start To break that down get into all coins or Eth or anything like that but we'll Leave that for future videos and for our Newsletter here so our crypto and Economic Insider report go and check That out link is in the top of the video Description name and email there you'll Find that link right at the top here and Of course with our Gan swing indicator Thanks again guys I've appreciated all Of those comments there from you guys Explaining what you've learned how You've found the value from the videos And what I can do more of to help you Out through this next ball stage of the Cycle so thanks once again like Subscribe check out the videos popping Up on your left hand side I'll see you From a new location tomorrow Thanks once again until then peace out