🇦🇺 (LIMITED TIME $20 FREE BTC) Swyftx, Best Australian Crypto Exchange

🔐 (LIMITED TIME $30 FREE BTC) Crypto Storage w LEDGER

🟠 (LIMITED TIME FREE BTC FOR 🇦🇺) Bitget Free $8,725 (US + Global Users NO-KYC)

🏆 (LESS THAN 24 HOURS) Free Crypto & Economic Report Emailed To You:

👾 Free TIA Community Discord:

📈 TIA Gann Swing Indicator

🔥 TIA Premium! Trading Courses & Exclusive Community

▶ Subscribe to the channel for more macro market analysis on Bitcoin, Crypto, Stock Markets and Real Estate Cycles.

UP TO $38,755 FREE! Crypto Exchanges

🥇 ByBit Free $30,030 + 0% Maker Fees (NO-KYC)

🥈 Bitget Free $8,725 (US + Global Users NO-KYC)

🇦🇺 Swyftx, Best Australian Crypto Exchange, $20 Free BTC

▶ My Official Socials ◀

YouTube

Instagram

Twitter

▶ My Must-Have Crypto Resources ◀

Education – TIA PREMIUM MEMBERS, Trading Courses & Exclusive Community

Charting – TRADINGVIEW ($30 Off)

Storage – LEDGER

Tax – KOINLY (20% Off)

Trading – TIA GANN SWING INDICATOR

Channel Sponsor: New Brighton Capital, Aussie SMSF specialists. Book your Free consult and use code “Pizzino” for $200 credit off:

This video is for entertainment purposes only. It is not financial advice and is not an endorsement of any provider, product or service. All trading involves risk. Links above include affiliate commission or referrals. I’m part of an affiliate network and I receive compensation from partnering websites. #crypto #bitcoin #cryptonews

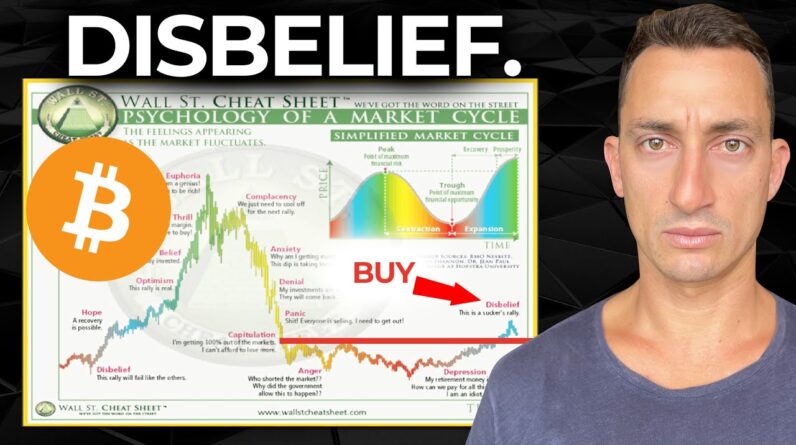

Oh sorry didn't see you there just Getting my skin routine on For my Natural Glow guys let's get into Bitcoin right now as the pump is on We're hitting 30 and a half thousand Dollars and I want to talk about why Getting to around mid 30s to 42 000 Bucks is not going to be a great sign For crypto investors we're going to take A look at that and compare it to the Market sentiment some of the biggest Crypto YouTube marketers are going full Steam for big price targets things may Be coming to an end but I'm not flipping Just relax hold your horses hit that Like button subscribe to the channel if You want to know more about my skincare Routine let me know in the comments Section down below it's how I keep my 25 Year old glow Without further Ado let's dive in to Today's video so we're looking at BTC The bullishness plenty of charts that we Have covered before so I want to update These right now these were some of the Big things that everyone was talking About as they do through the end of 2022 2023 now we saw this quite often and This is one that I have compared to Quite a lot in 2021 the Wall Street Cheat sheet psychology of a market cycle Now the common thought here was that This rally that we are seeing on bitcoin Was actually this first little pump out

Of the anger drop so you can see here That we had a drop with from the Capitulation and then a drop into anger And then this rally out everyone thought Into February was going to be this move To the top before we saw a further Decline into the depression and we were Talking specifically here on the channel About why we didn't think this was the Case and why this move in February and March launch was actually the start of a News cycle especially when the market Sentiment came in during the banking Collapse this is when even the biggest Names the guys who I respect they're Pretty good people We're looking at these markets going Further down and I think they still do And they're sort of pushing this time Frame out now to the end of 2023 the Second half of 2023 and this is what Exactly what will happen with the Bears In the camp right now they're going to Keep pushing that timeline out and time And keep pushing and pushing and start To miss the move to the upside so in Terms of the psychology of a market we Can now see several weeks on that it's Probably likely we're in a disbelief Stage we're in a suckers rally going From the low here in November the Depression remember there was a lot of Anger with FTX collapsing and of course The depression with a lot of people

Losing their entire accounts through the FTX collapse through the Celsius call it The C5 collapse you had Celsius Voyager Block fight then you had the funds Three-hour Capital Etc okay then you had the may drop which Was a capitulation I would say through May and June that was uh St and Luna People losing a lot of money through That through that stage of the market so You might note here that you've got Complacency and it doesn't exactly line Up with the chart here that doesn't Matter these things don't have to line Up to the exact point what is important Is to understand where The psychology of the market is during That cycle itself on the market that you Were trading and we could see that we Had that first drop from November into That low and then there was a fair bit Of complacency here I'm not saying I'm Perfect I would have had some Complacency at that time as well I Definitely had complacency with Bitcoin And ethereum definitely so I'm not Perfect and looking back on it learning From our mistakes that was definitely Complacency this complacency bounce into The Miami Bitcoin Miami Conference right So that's what happened there then we Had the drop so even though on the Wall Street cheat sheet you can see in the Background it's showing up as a drop and

Then a complacency bounce we had a quick Drop it's cryptocurrency it drops harder And then we had a complacency bounce Here before we had all of the move to The downside the anxiety the denial the Panic probably this here and then the Capitulation into that June low which Was essentially basically where the Price stopped sure it went a tiny little Bit further but then we've bounced Pretty hard from that point so if you Were buying in June at 17 and a half Like we talked about here on the channel Looking at our ranges for uh for the Decline into the bear market then you'd Be sitting pretty right now the lesson There is these things take time they Take months and months to play out from June to where we are now you're almost At 100 return but you had to endure all Of that pain from June into November low Then wait out December six months then You finally got that pump into January To basically break even before you got Slammed again with the svb collapsing And Credit Suisse and Deutsche Bank and Everything else going on in March and From that point we're now up 50 from 20 Grand to 30 grand so you can see how Quickly the tides can change and I'm Very much in the belief here that we're In the disbelief stage of the Wall Street cheat sheet based on what I can See across the market these Market

Cycles and Market sentiment don't only Occur in Bitcoin and cryptocurrency they Occur everywhere because humans make up Markets regardless of whether you've got A bot trading or some other sort of Algorithmic trading going on a human had To create the trading program they have To go and buy and sell these markets This Market here USD we're looking at The US dollar here remember on the Channel we specifically talked about the September top you guys can keep a Counter how many times I've brought this Up but it's a really important case to Make especially when the news was Telling us how great the US dollar was The market has collapsed so I bring that Up again because of what we're seeing Right now with the US dollar you would Definitely have seen the fear that Russia and China are teaming up the Brics countries the Brazil Russia India China South Africa are all teaming up to Drop the US dollar and remove the Dominance and the uh the use of the Dollar deep dollarizing basically you Can see everything here from the last Few days to the last month or so the News has been very intense to try and Tell us that the US dollar is imploding And collapsing thanks news thanks for Telling us all the bad stuff at the Bottom of the market that's why I think Now yes overall I think the USD is still

Going to go down based on our cycle here Our 18 to 20 year real estate and Economic cycle which we still have a Little further to go so not to bring too Many things into the equation here but Because we have all this heavy news Right now And we're not seeing lower prices and We're seeing a higher low for now and On top of that we're seeing support on These 50 levels at around 100 to 102. There is a chance that the US dollar Attempts once again to push to the Upside it doesn't have to be a huge move To the upside I'm not saying it's going To go to new fresh highs to break this Peak here I don't think it has it in it But there might be a little bit of a Move here let's see how far it goes but If it does have a move that's going to Affect what happens on bitcoin And of course the price of Bitcoin Whether Bitcoin is going to hold steady Or continue to pump speaking of pumps Before we get to the 42 000 bucks why That's not a good sign for crypto Investors right now we're piecing it all Together with the market sentiment don't Forget that the Wyckoff schematic this Was another one that everyone was Looking at to call that we're about to Go from into a phase B into a phase C so That's uh that's looking at it from this Point here phase B which would drop into

A phase C into a spring but my count was Earlier than that I was looking at the Selling climax being in June and the Spring being in November so I ran this Phase C here you can see the spring and The test and during this period where March happened and the banks collapsed And the market sentiment was extreme it Was extreme The market has now bounced away from That point so this is something that I Posted up on Twitter remember the links To all the stuff are in the video Description down below limited time here For Swift x uh customers new customers You can get double Bitcoin 30 bucks for Ledgers and if you're in Aussie you can Get some more free BTC if you sign up For bitget as well so they're my shield Links at the top of the video Description go check those out there's Also 24 hours less than 24 hours for our Crypto and economic report that's coming Out today get a hold of that it's got Real estate it's got Bitcoin and Cryptocurrencies okay so back to the Wyckoff schematic here with this Breakout and a further breakout now We're at 30 000 guys we're up this level Right here we're probably well and truly Into phase e if you disagree please do Let me know down below but I think by This stage many people are starting to See that it was in fact a phase ABC that

We looked at for the spring and then We're bounced out so this is all just Piecing together the bullish narrative Here because of how long ago five months Was the low five months ago we saw the Low but only now are we starting to see A lot more bullishness people are Getting very excited about these prices Sure I'm jumping on the bandwagon but I've been talking about it from those Periods before and I'm just having fun With it right now but I do think we'll Start to see a peak come in as I've Talked about April or May which is going To be a critical point because crypto Investors are coming back to the party And probably buying the tops again on Altcoins Now this was the other chart that I'd Posted up as well looking at BTC as it Leaves the green bear Zone it usually Doesn't come back to this zone until the Next bear Market cycle if you want to See more of that like I said Twitter is In the video description I'll bring this Up again on the channel but essentially This is just to add a piece to the extra Bullish narrative which has begun many Many months ago so it's to try and Understand the timing of where we are Although it might may seem right now That things are starting to seem safe And bullish and Bitcoins got to go and Test 42 or 47 or maybe 50 000 or maybe

We see sixty thousand or a new all-time High in 2023 I don't think that's the Case but that's what we're starting to Feel now which is why I keep bringing up The news events and the examples that we Talked about here on the channel looking Specifically at the US dollar and other Times during the Bitcoin bear Market Just to remind ourselves that this bull Run did start five months ago and things Do twist and turn and flip and flop and Eventually we will see a peak and Probably a little bit of a decline let's See where the peak comes in first from a Graphical point of view in terms of the Market sentiment the fear and grid index Is hitting new fresh highs you can see Back on 21st of March is at 68 and just Yesterday we're at 68 as well today we Closed in at 65. so this was the level That we're looking at around the 70 Mark For some sort of resistance we do know That it can push to around the 80s or Mid 80s before we do get a pullback it Starts to get a little bit volatile at These areas because this is where the Dumb money comes on a lot of retail Comes back even the big players with big Money can be done money as well because They're coming back too late they're the Ones who thought the market was Completely bearish and now we're Starting to see higher and higher prices And they start to come into the market

So what we're seeing now is this 70 Level and we're starting to knock our Heads on this level so I suspect we're Going to get to some sort of volatility In the emotions of the market even Though it could head higher and that Usually gives a signal that the top is Coming in not the cycle top not the end Of it an intermediate top keep that in Mind an intermediate top so these levels That we're looking for 42 000 why that's An important level well it's 50 from the Cycle low the bear Market cycle low I do Know many people still believe that it's Going to go below 15 and a half thousand Probably not the case We have looked at reasons why 31 000 is Probably that big flipping Point looking At an over balance in time and price Which I have posted on in Twitter Looking at hitting around 31 000 giving Us that over balance in price and time 42 000 being the 50 level so we have Those two key levels Market gets to These uh price points around that 31k Definitely 15 15K kiss that goodbye That's gone probably even into the 18 Case but I want to see the market get Back to the complacency top that was That marker right there around 48 000 then you can kiss goodbye basically All of these lower levels here it's not Coming back to that zone but if it does Creep up to those prices we can get a

Good solid pullback and still be in a Bullish Market this is where the Bears Will think that they have won the game But you'd also have Retail investors buying up cryptos as it Gets higher and higher so this is where They're going to get absolutely Destroyed this is where the market Sentiment and the hype comes in it looks Like we're leaning into that right now Probably the end of this move whether it Goes to the mid 30s whether it gets to Low 40s whether it gets to high 40s I Don't know the point is I'm trying to Express here that when the media like we Saw with the US dollar like we've seen With Bitcoin plenty of times before like We've seen with absolutely every other Market when the media gets really really Hot then you're probably towards the end Of that move the move could start at Around 30 and go to 40 so it's still a Pretty significant dollar point but what We could expect is a significant Pullback from that point where would it Pull back to let's see where the top Comes in and then look back to where These levels are where the previous Resistance was which may become support And so far two key candidates providing We just go straight up but basically the Two levels so far around this High 28 Thousands to that low 29 thousands and Beneath that level you have the 26 and a

Half down to the 25. so right now that Could be a significant area that the Market comes back to test call it 29 is A round number but we've got to see Where this top comes in and see whether We get that that pull back so that's why I'm running up to 42k is going to be Very very bad for a lot of retail crypto Hopefully you guys here that are Watching subscribed liking the content Clicking all the links down below to get That free crypto and economic report uh Wiser than to ape in to alt coins and Hope for the best that they're going to New all-time highs that is not going to Happen at this stage right now generally Speaking across the board looks like History is repeating again similar to 2019 not saying a 300 run but we're Seeing a significant move to the upside This period was six months to the Downside you could get six months Sideways but keep an eye on how long This move lasts and then we'll get an Idea of what that next setup move looks Like the top could come in and the Market just go nowhere for many many Months and that would then squeeze out Those investors who unfortunately buy Late so keep an eye on the time frames Follow the channel join us in Tia Premium if you want to learn how to Master the Cycles in crypto real estate And the stock markets otherwise I'll see

You here back at the next video don't Forget your skincare routine keep that Nice and clean and I'll see you guys at The next one until then take care and Peace out