➢ Disclaimer: This video is for entertainment purposes only. It is not financial advice and is not an endorsement of any provider, product or service. All trading involves risk. Links above include affiliate commission or referrals. I’m part of an affiliate network and I receive compensation from partnering websites. Swyftx, ByBit, BingX and Bitget are channel sponsors. All decisions you make are your own. #crypto #bitcoin #cryptonews

The Imminent Collapse of Stocks, Crypto, and Real Estate: Fact or Fiction?

In recent discussions, there has been a resounding warning of an impending collapse in stocks, cryptocurrencies, and real estate. But are these claims substantiated by data, or are they merely sensationalized predictions? Let’s delve into the facts and figures to decipher the likelihood of such a catastrophic event.

Understanding the Rarity: A Stock Market Collapse Occurs Once in 20 Years

The notion of a stock market collapse is often met with skepticism due to its rarity. Historical data spanning 97 years provides us with valuable insights, revealing that such collapses are indeed infrequent, manifesting approximately once every two decades. But what does this data truly signify for investors?

Analyzing Historical Performance: A Data-Driven Approach

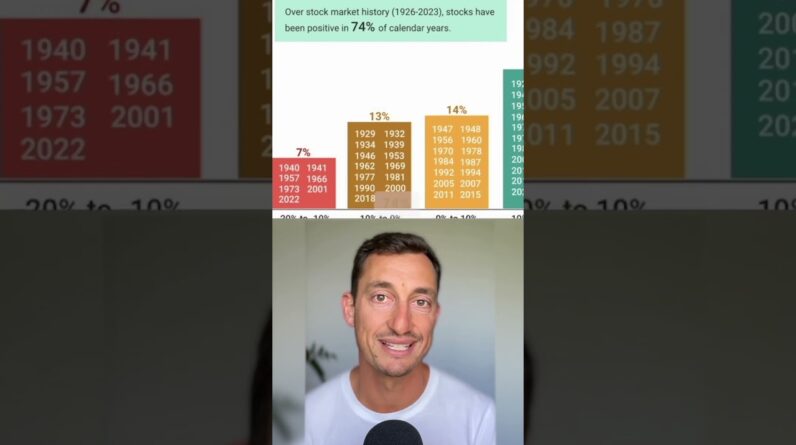

To comprehend the gravity of a potential collapse, it’s imperative to scrutinize the historical performance of the stock market. Examining data from Open to Close over 97 years, we observe that only 6% of the time did the market close under 20% from its opening value. These figures shed light on the resilience of the market even amidst turbulent times.

The Threshold of Decline: Insights into Market Fluctuations

Digging deeper, let’s explore scenarios of declines greater than 10%, which encompass a broader spectrum of market turbulence. Surprisingly, such occurrences only extend to 133% of the total analyzed period, spanning merely 13 years. This emphasizes the inherent stability of the market over extended durations.

The Silver Lining: The Overwhelming Positivity of Market Closures

Contrary to the prevailing narrative of doom and gloom, data reveals a remarkable trend of positivity in market closures. Over 74% of the time, the market concludes in the positive, dispelling apprehensions surrounding sustained downturns. This statistic underscores the enduring resilience of the market over time.

Navigating Amidst Market Noise: A Strategy for Success

In a landscape saturated with sensationalized forecasts and media frenzy, it’s crucial for investors to remain grounded and focused on data-driven insights. By eschewing market noise and adhering to a disciplined approach, investors can sidestep the pitfalls that ensnare over 90% of market participants. Embracing this approach fosters a path towards informed decision-making and sustainable growth.

Embracing Data Amidst Market Uncertainty

As we confront the specter of potential market collapses, it’s paramount to anchor ourselves in data-driven analysis rather than succumbing to fear-induced narratives. While acknowledging the occasional turbulence, historical trends underscore the resilience and positivity inherent in market closures. By adopting a disciplined approach and filtering out market noise, investors can navigate uncertainty with confidence and clarity. So, let us heed the call to prioritize facts over conjecture and steer towards prosperity amidst market fluctuations.

![THESE BITCOIN WHALES JUST FOOLED EVERYONE! [Exact strategy....]](https://www.cryptocurrents.net/wp-content/uploads/2024/08/these-bitcoin-whales-just-fooled-everyone-exact-strategy-WhgubJxMmeA-796x445.jpg)

![WARNING: EVERY BITCOIN BEAR WILL BE LEFT CRYING [Huge chart.....]](https://www.cryptocurrents.net/wp-content/uploads/2024/08/warning-every-bitcoin-bear-will-be-left-crying-huge-chart-jgadWvvgEJw-796x445.jpg)